In the context of a wholesale company, the “outstanding balance” typically refers to the amount of money that is owed to the company by its customers for products or services that have been provided but not yet paid for. It represents the unpaid invoices or outstanding accounts receivable that are pending settlement by customers.

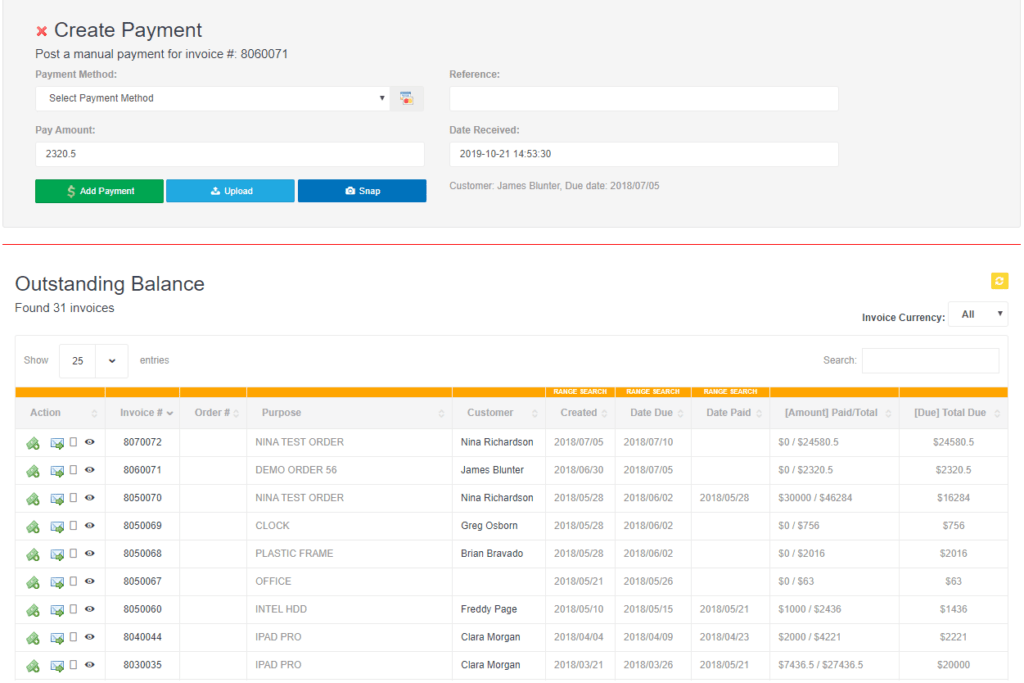

ALL-IN-CRM, Outstanding Balance

Here’s how it works in ALL-IN-CRM:

Customer Orders: A wholesale company receives orders from various customers for products they want to purchase.

Invoicing: The company generates invoices for these orders, specifying the products, quantities, agreed-upon prices, and payment terms.

Product Delivery: After the products are prepared and quality-checked, they are shipped or delivered to the customers, along with the respective invoices.

Customer Payment: Customers are expected to make payments for the products according to the agreed-upon payment terms. These terms may vary, but they often include conditions such as “net 30” (payment due within 30 days).

Outstanding Balances: The outstanding balance is the sum of money that customers owe the wholesale company when payments are delayed or have not been made yet. It represents the accounts receivable that have not been settled.

Managing outstanding balances is a crucial aspect of financial operations for wholesale companies. It affects cash flow, and efficient management is essential to maintain liquidity and ensure the company’s financial stability. Strategies for handling outstanding balances often include regular follow-ups, incentives for early payment, transparent communication, and, in some cases, debt collection procedures if customers do not settle their dues within a reasonable timeframe.

Overall, the outstanding balance reflects the financial health of a wholesale company and its ability to collect payments owed by customers.